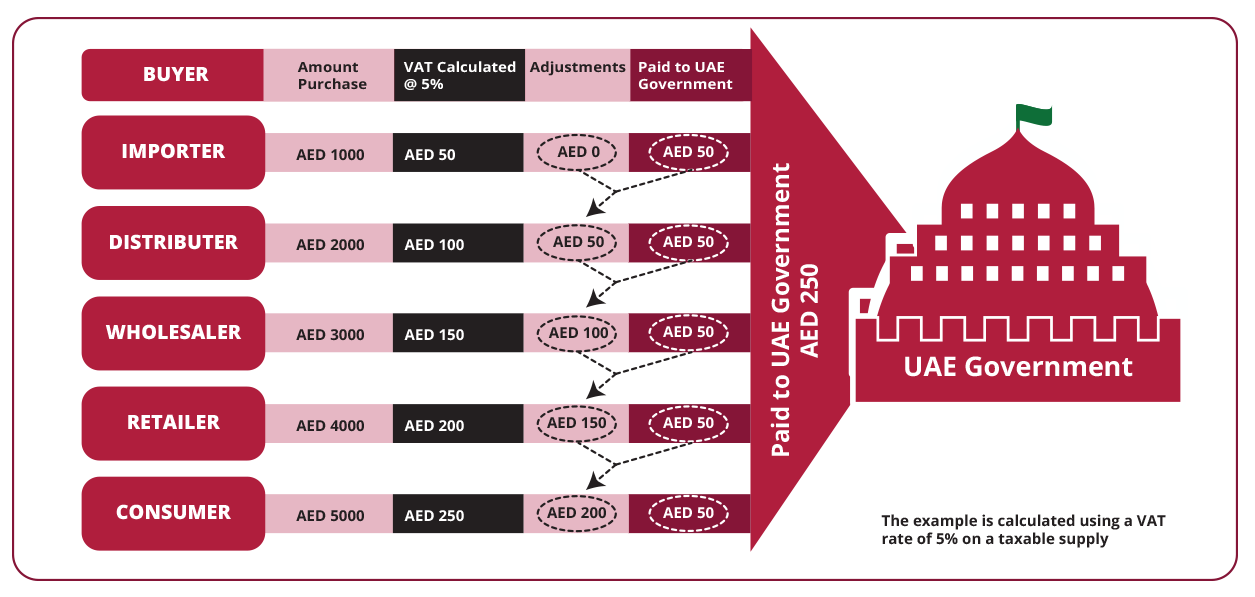

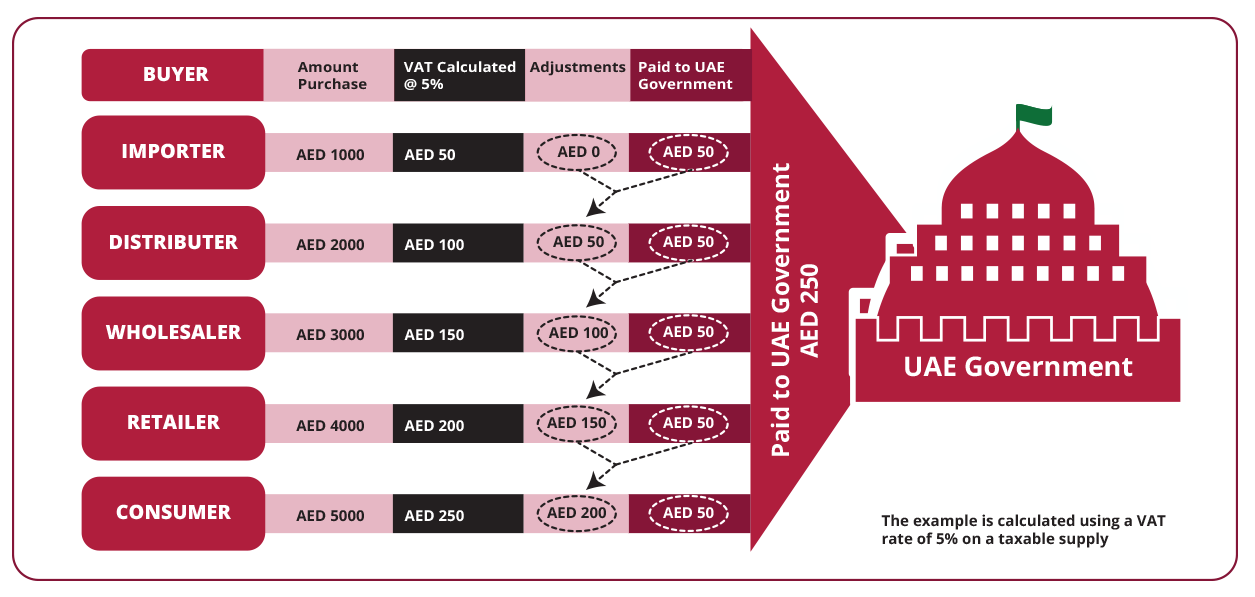

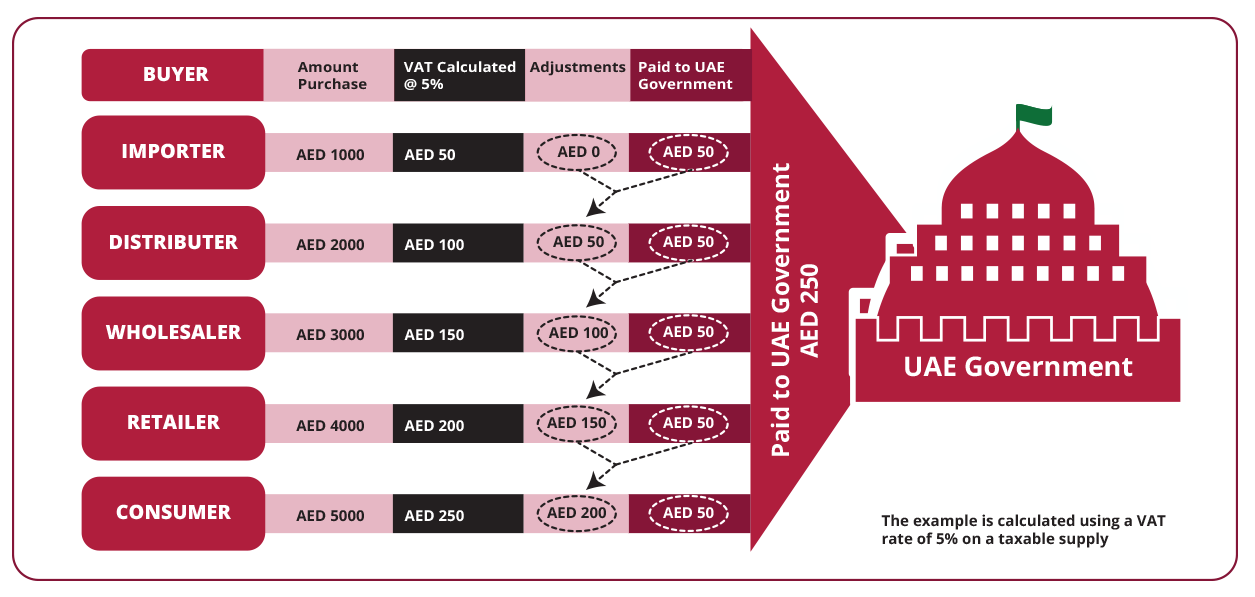

TRAIN in Ph = VAT in UAE

Newsline Philippines

Mobile: +63917 150 8377

Email Address: [email protected] or [email protected]

By Jerick Wee

By Paul Palacio

By Paul Palacio

Newsline Philippine website welcomes healthy discussion, exchange of opinions friendly debate, but comments posted by our readers does not reflect the views and opinion of Newsline Philippines.

Newsline Philippines reserves the right to delete, reproduce, or modify comments posted here without notice. Posts that are inappropriate and does not follow community standard will automatically be deleted.

Leave a Reply

You must be logged in to post a comment.